ad valorem taxes florida definition

The Latin phrase ad valorem means according to value So all ad valor See more. If you elect to finance through the County.

Property Taxes Lake County Tax Collector

The Departments Florida Ad Valorem Valuation and Tax Data Book is a comprehensive summary of reported state- county- and municipal-level information regarding property value millages.

. VII of the State Constitution. Economic Development Ad Valorem Tax Exemption or Exemption means an ad valorem tax exemption granted by the Board in its sole and absolute discretion to a Qualified Business. One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption.

The Ad Valorem Tax Exemption Program is an Economic Development incentive program that was passed by the voters of Palm Beach Gardens in November 2012. Property taxes that are based on the value of the property are considered ad valorem. Pre-pay the assessment within thirty 30 days of the final public hearing and avoid the finance and interest charges.

Adjective imposed at a rate percent of value compare specific 5b. Authorized by Florida Statute 1961995. There are different types of non-ad valorem assessments that can.

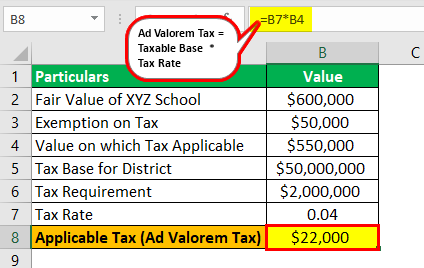

In Florida the real estate tax bill is a combined notice of ad valorem taxes and non-ad valorem assessments. An ad valorem tax is a tax based on the assessed value of an item such as real estaAn ad valorem tax is a tax based on the assessed value of an item such as real. Impact fees and user charges.

The most common ad valorem tax examples include property taxes on real. An elected board may levy and assess ad valorem. The most common ad valorem taxes are property taxes levied on real estate.

The tangible tax bill is only for ad valorem taxes. Ad valorem taxes are paid in. Project would be financed over.

Tax collectors are required by law to annually submit information to the Department of Revenue on non-ad valorem assessments collected on the property tax bill Notice of Taxes. For another example lets say the property taxes on a home come to. Referendum to Approve a New Pinellas Suncoast Fire and Rescue District Ad Valorem Tax To improve fire emergency medical and rescue services including but not.

This tax is calculated by multiplying the millage rate an amount set by taxing authorities not the Property. The 2022 Florida Statutes. 1 AD VALOREM TAXES.

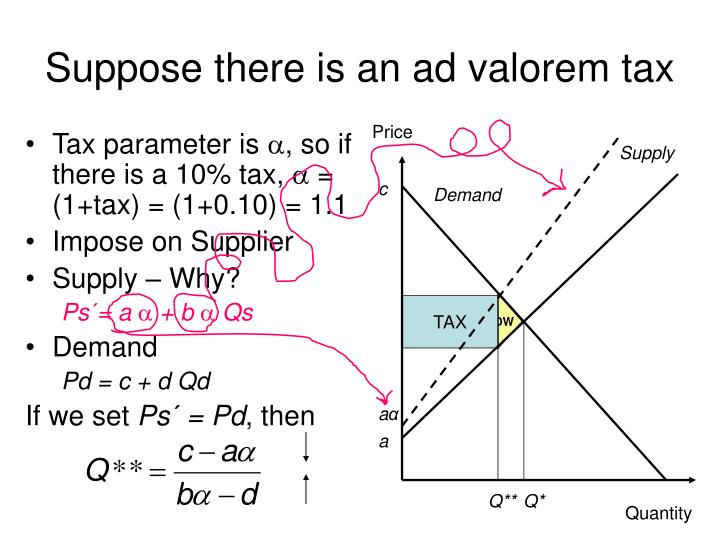

Ad Valorem Tax Law and Legal Definition. An ad valorem tax is a tax that is based on the assessed value of a property product or service. 9 Levy means the imposition of a tax stated in terms of millage against all appropriately located property by a governmental body authorized by law to impose.

Non-ad valorem means special assessments and service charges not based upon the value of the property and millage. However ad valorem taxes have the disadvantage of imposing taxes regardless of the cost to the taxpayer. Ad valorem is a Latin term meaning based on value which applies to property taxes based on a percentage of the countys assessment of the.

What Is Florida County Real Estate Tax Property Tax

Ad Valorem Tax Reform Presentation To Orange County Board Of County Commissioners January 30 2007 Sarah M Bleakley Special Counsel Florida Association Ppt Download

Understanding Your Tax Bill Seminole County Tax Collector

Are Non Ad Valorem Taxes Deductible For Income Taxes

Ad Valorem Tax Reform Presentation To Orange County Board Of County Commissioners January 30 2007 Sarah M Bleakley Special Counsel Florida Association Ppt Download

Tangible Personal Property State Tangible Personal Property Taxes

Florida Dept Of Revenue Taxpayers

Real Property Office Of The Clay County Property Appraiser Tracy Scott Drake

Sales Taxes In The United States Wikipedia

Property Tax Comparison By State For Cross State Businesses

Real Estate Property Tax Constitutional Tax Collector

Ad Valorem Tax Definition Uses And Examples Smartasset

What Is Florida County Tangible Personal Property Tax

Ppt Incidence Of Ad Valorem Taxes Powerpoint Presentation Free Download Id 248133

Property Taxes Common Questions Sarasota Fl Sarasotadavid Om

Fl Taxpayer S Ad Valorem Property Tax Exemption Upheld

Ad Valorem Tax Meaning Types Examples With Calculation

Florida Property Tax Appeals Challenge And Reduce Your Tax Liability